Article content

(Bloomberg) — The one thing UK Foreign Secretary Liz Truss insists she will not be in the Conservative Party leadership run-off against former Chancellor of the Exchequer Rishi Sunak is “the continuity candidate.”

[ad_1]

The one thing UK Foreign Secretary Liz Truss insists she will not be in the Conservative Party leadership run-off against former Chancellor of the Exchequer Rishi Sunak is “the continuity candidate.”

Author of the article:

Bloomberg News

Philip Aldrick and David Goodman

Publishing date:

Jul 24, 2022 • 21 minutes ago • 5 minute read • Join the conversation

(Bloomberg) — The one thing UK Foreign Secretary Liz Truss insists she will not be in the Conservative Party leadership run-off against former Chancellor of the Exchequer Rishi Sunak is “the continuity candidate.”

This advertisement has not loaded yet, but your article continues below.

She is the Prime Minister-in-waiting with a “bold plan … to reform the economy. A true tax-cutting, freedom-loving Conservative.”

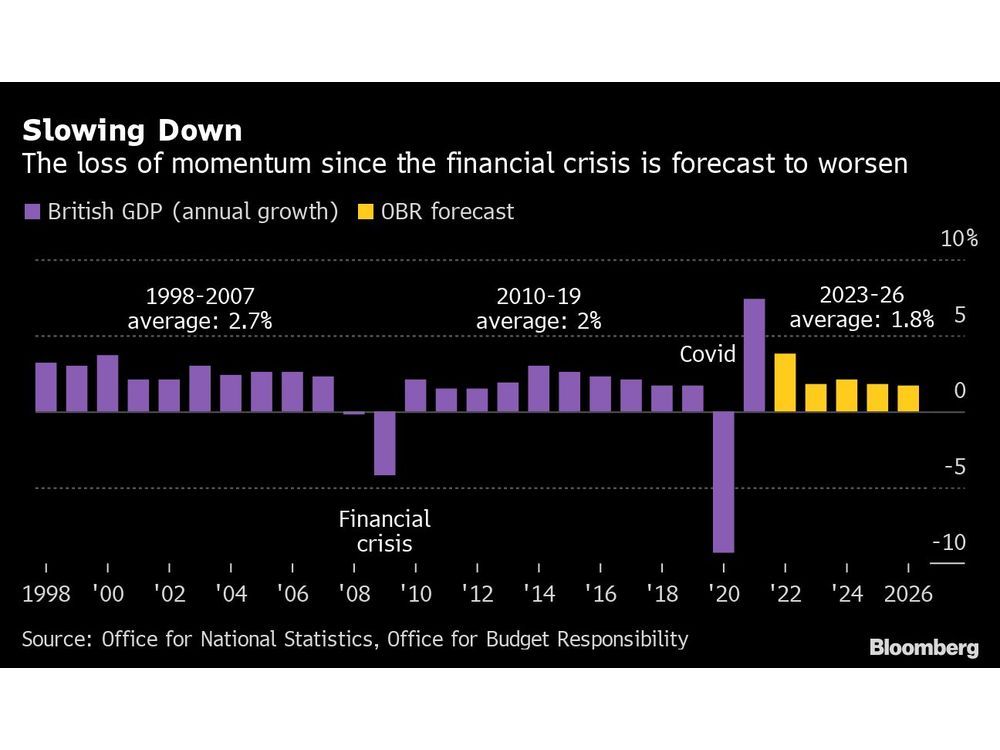

By bold, Truss means she will break from the “economic orthodoxy” of the Whitehall civil service that “resists change.” She means the Treasury and Bank of England, and supporters in the City of London and academia, whom she blames for failing to deliver growth since the financial crisis.

On that measure, she scored an early victory. Citigroup Inc.’s Chief UK Economist Ben Nabarro said she “poses the greatest risk from an economic perspective with an unseemly combination of pro-cyclical tax cuts and institutional disruption.”

Truss’s economic plan would fuel inflation and prompt quicker interest rate increases from the Bank of England than if Rishi Sunak led the nation, a Bloomberg poll of UK economists showed. Eight of the nine economists surveyed by said Sunak would handle the economy better than Truss, with one preferring the foreign secretary.

This advertisement has not loaded yet, but your article continues below.

But economists from outside the establishment she refers to as the “blob” have questioned how radical her plans are and whether they are sensible.

Beyond the rhetoric, Truss’s tax cuts only reverse recent rises and amount to little more than a return to 2019 settings, when she believes policy was failing.

Even an eye-catching proposal to review the Bank of England’s 2% inflation mandate merely resurrects a 2019 announcement that was jettisoned when the pandemic struck. One option under consideration is a nominal GDP target, which combines growth and inflation — a policy that was reviewed and rejected a decade ago.

Julian Jessop, a fellow at the Institute of Economic Affairs free market think tank who is backing Truss, says all that really distinguishes her from Sunak is timing, despite the former chancellor’s record of raising taxes to their highest level since the 1940s.

This advertisement has not loaded yet, but your article continues below.

“The similarities between Rishi Sunak and Liz Truss are bigger than the differences,” Jessop said. Both have a set of supply-side reforms to catalyze productivity, both will use “Brexit freedoms” to deregulate, both will trim wasteful spending and both want to cut taxes.

The difference is that Sunak would wait to reduce taxes until he has “gripped inflation,” which would mean a delay of no more than 18 months on current forecasts.

Tim Congdon, a Whitehall skeptic who advised Margaret Thatcher in the 1980s and is close to two prominent Brexiteer MPs backing Truss — Bill Cash and John Redwood — opposes her tax cuts. Congdon says tax cuts now will drive up inflation by increasing money growth.

Gerard Lyons, Boris Johnson’s former adviser, was backing Penny Mordaunt, the leadership contender beaten by Truss in the final vote of Tory MPs. Under Lyons’ guidance, Mordaunt planned a more radical attack on the “blob” by splitting the Treasury in two — an economic growth and a budget unit.

This advertisement has not loaded yet, but your article continues below.

Lyons was more cautious on tax cuts, suggesting a £15 billion giveaway targeted to “return the windfall gain for the Treasury from inflation back to the public.” A proposal to halve value-added tax on fuel would have mechanically lowered inflation.

Truss’s plan is to reverse April’s increase in national insurance, a payroll tax, and scrap next year’s planned corporation-tax rise in an “emergency budget” at which she will announce a review “to find efficiencies in government spending.” Sunak kick-started a similar savings review in March.

She says the cuts, worth more than £30 billion including a one-year moratorium on energy levies to help households through the cost of living crisis, would stave off a recession and meet the government’s fiscal rules.

This advertisement has not loaded yet, but your article continues below.

She even made the bold claim that they would be deflationary, citing Patrick Minford, who is helping Truss’s campaign and advised Thatcher in the 1980s.

Minford argues that lowering payroll levies draws people into work by letting them keep more of their earnings. By increasing labor supply, domestic wage pressures would ease.

Mainstream economists say tax cuts lift spending power and are inflationary. They point out his Brexit forecasts were wrong and even fellow Brexiteers distanced themselves from him.

Jessop agreed that lower taxes would have limited impact on prices. In June, the BOE estimated that a net £10 billion fiscal package to help households with living costs would add 0.3% to GDP growth and just 0.1 percentage point to inflation.

This advertisement has not loaded yet, but your article continues below.

Those calculations suggest the inflationary impact of a £30 billion package would be small, particularly set against the current 9.4% inflation rate, Jessop said. Any increase could be countered by interest-rate rises, he added.

For Minford, higher rates “are badly needed” to reward savers after years of near zero returns. He told The Times “a normal level is more like 5%-7%” than the 1.25% today. Tory party members who vote for the next leader have an average age of 57 and are likely to have built up savings.

Congdon said he is “on Sunak’s side” when it comes to tax not only because of his inflation concerns.

“I am worried about the impact on the debt-interest bill,” Congdon said. “Sunak is saying he would control the deficit before cutting taxes. That is what Thatcher stood for.” Congdon backs Truss’s review of the BOE mandate but has yet to decide who he will vote for.

This advertisement has not loaded yet, but your article continues below.

Truss is more “Reaganite” than Thatcherite, a reference to former US President Ronald Reagan, said John Hawskworth, an independent economist. Reagan cut taxes and hoped “the deficit deals with itself.” “It didn’t,” he said.

As radical as she may claim the tax cuts are, the foreign secretary plans to use no more than the fiscal headroom Sunak set aside. At the March budget, the government had £28 billion ($33 billion) for giveaways within its rule for debt to be falling as a share of GDP.

Truss said her plans “can be paid for within the existing fiscal envelope.” That is possible because higher inflation has probably created “a little more room,” said Dan Hanson, senior UK economist at Bloomberg Economics.

The Tory Right believes that after 12 years in power the “Whitehall Blob” has turned the party into soft-touch, high tax, economic liberals more like the Labour Prime Minister Tony Blair than Thatcher.

Truss wants to be seen as the candidate who can draw a line under that era, whether or not her actions match her words.

This advertisement has not loaded yet, but your article continues below.

Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Financial Post Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

[ad_2]

Image and article originally from financialpost.com. Read the original article here.