Yuga Labs, founder of the Bored Ape Yacht Club NFT collection, is being probed by the U.S. Securities and Exchange Commission as to whether nonfungible tokens are considered unregistered securities, Bloomberg reported Tuesday.

The agency is looking at whether certain NFTs from Yuga Labs are more like stocks and should adhere to the same disclosure rules, Bloomberg reported, citing unnamed sources. The SEC is also looking at the distribution of an Ethereum-based ApeCoin token that launched this year, the report said.

Yuga Labs has not been accused of any wrongdoing and the opening of a probe doesn’t mean the SEC will file a lawsuit, the report said. Yuga Labs did not respond to request for comment from MarketWatch. The SEC declined to comment.

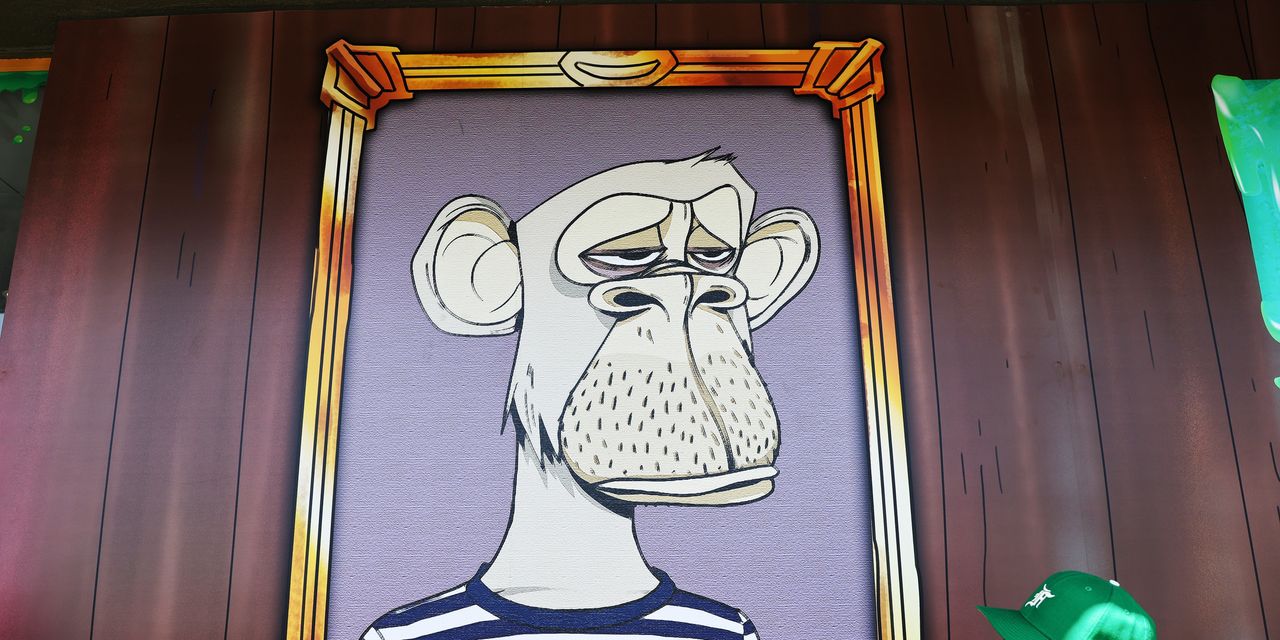

The Bored Ape Yacht Club, which surpassed $1 billion in sales on OpenSea in January, is one of the most popular NFT collections, with holders like Jimmy Fallon, Paris Hilton, and Eminem.

Earlier this year, SEC Chair Gary Gensler said he would focus on crypto to ensure platforms, stablecoins, and tokens adhere to regulations.

“The fact is, most crypto tokens involve a group of entrepreneurs raising money from the public in anticipation of profits — the hallmark of an investment contract or a security under our jurisdiction,” he said in April. “Some, probably only a few, are like digital gold; they may not be securities. Even fewer, if any, are actually operating like money. When a new technology comes along, our existing laws don’t just go away.”

In recent years, the SEC has investigated dozens of cases in which digital asset firms failed to register offerings. In February, BlockFi paid a $50 million penalty and ceased its unregistered offers and sales.