[ad_1]

Introduction by Matthew Piepenburg

In this refreshingly fact-focused report, Matterhorn Asset Management (MAM) advisor, Ronni Stoeferle, takes a deeper look at the false “eco war” on gold.

In a world of ever-growing public narratives completely at odds with transparent reality (from “Putin’s” war to “Transitory Inflation”), it should come as no surprise that the current ESG and “Green Revolution Army” of the woke West has turned its political gun sights toward the one precious metal which serves as the greatest threat to a dying fiat currency system: Gold. With puffed chests and lofty claims, global environmental leadership has conveniently made a disingenuous but full-frontal assault on gold mining (and hence gold) as an environmental threat.

How convenient…

Fortunately, Ronni’s analysis of gold’s use/consumption data, CO2 characteristics and environmental comparisons to conventional fiat currencies provides a far more fact-based (rather than politically-charged) context to this otherwise bogus war on history’s most precious of metals.

5 Reasons Why Gold Is Green

In the gold industry, too, ESG is now on everyone’s lips. Behind the letter abbreviation ESG lies the endeavor to motivate companies to actively pursue ecological, social and good governance targets. ESG ratings offer investors and NGOs the opportunity to track progress in this effort and identify the best companies in the industry.

However, it is wrong to limit the concept of sustainability only to these ESG ratings. After all, the ratings only evaluate the mining companies, but not the precious metals themselves. Gold suffers particularly from this limited view of sustainability. For example, gold mining is usually reported in a negative context. Inhumane working conditions in some gold mines in Africa or the environmental threat posed by cyanide contamination are the focus of this reporting.

The detection of such misconduct is undoubtedly justified and important. However, the fact that such news completely discourages environmentally conscious or socially committed investors from investing in the yellow metal is an exaggerated reaction. It may sound surprising at first glance: Environmentally conscious investors should focus on gold as an investment instrument. Gold is green because

- gold is used and not consumed

- CO2 emissions only occur in the relatively insignificant mining of new gold

- gold is versatile in its use

- many other raw materials perform significantly worse ecologically

- fiat money also has a poor environmental record.

1. Gold is used and not consumed

In the public debate, truncated representations are currently very much in vogue. Electric cars are considered climate-friendly because, unlike cars with internal combustion engines, their operation does not cause any emissions. Any additional emissions and environmental impact caused by electricity production and the manufacture and scrapping of the car are not taken into account. In this context, however, only the overall view over the entire life cycle should be relevant for an ecological assessment. And in this view, gold is indeed the most sustainable metal in the world because of its elementary properties, the extraction process and its stable value.

Gold has been mined for more than 7,000 years. During this period, more than 205,000 tons have been produced, which is equivalent to the size of about 3.5 Olympic swimming pools. More than half of this has been mined since the 1950s. Crucial to gold’s sustainability and environmental footprint is that virtually all of the gold ever mined is still in use. With every gold jewelry, every gold coin, every gold bar, there is some chance that some of it has been used for many centuries, perhaps even millennia. Unlike consumer goods such as food, commodities, but also real estate, gold is not consumed, but merely used.

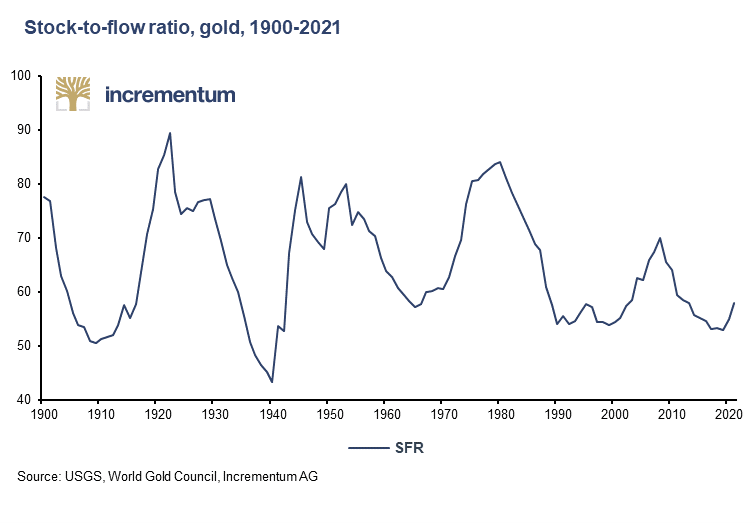

Therefore, new gold production is hardly significant in an overall view, as the stock-to-flow ratio demonstrates. The current value of around 58 means that the amount of gold already in existence is 58 times the amount of the current annual new production. In other words, the annual “inflation rate”, i.e. the growth of the global gold stock compared to the already mined and further used (!) amount, is low and relatively stable. It fluctuates between 1.2% and a maximum of 2.4%.

As a precious metal, gold is characterized by the fact that it does not chemically react with air or its components such as oxygen, carbon dioxide and other gases. This protects gold from losing its luster. Gold therefore remains in its purest form forever. This makes it the perfect investment vehicle that can be passed down from generation to generation. The social and environmental costs of gold mining can consequently be spread over an almost infinitely long period of time, making them converge towards zero. The permanence of gold also means that gold never has to be disposed of as waste. No one will voluntarily throw gold away, but will want to recycle it for profit.

2. Significant CO2 emissions are incurred only during mining

The current strong focus on curbing CO2 emissions to combat climate change should also lead to a stronger focus on gold among investors. This is because gold is a decidedly CO2-friendly metal and investment.

Three different sources are distinguished in the attribution of CO2 emissions. Scope 1 emissions cover those climate-damaging emissions that are released within the company itself, Scope 2 includes those emissions caused by the company’s energy suppliers, and finally Scope 3covers those thatoccur in the upstream and downstream supply chain.

For many products, the good part of the emissions arises in the upstream and downstream supply chains, i.e. Scope 3. However, the Scope 3 emissions of gold mining companies are almost negligible, as a gold bar is very rarely further processed. Furthermore, Scope 1 and Scope 2 CO2 emissions per ounce of gold produced are extremely low for large operations.

The comparison with other raw materials makes this clear. The production of aluminum consumes almost 11 times as much CO2 per US dollar of production value, steel more than 5.5 times, coal almost three times and zinc more than two times. Copper is in the region of gold, lead slightly below, while iron ore is much more CO2 -friendly, with around two-thirds fewer emissions. However, gold recycling produces 90% fewer CO2 emissions than gold mining, and about 25% of annual gold demand is met by recycling alone.

In addition, gold that has already been mined does not cause any additional emissions, as these are generated exclusively during the mining and refining of the gold. Gold is used and not consumed. Consequently, the possession of physical gold does not produce any emissions. Only the processing of gold into jewelry and the industrial use of gold emits a small amount of additional CO2. Over time, physical gold will therefore continue to reduce the emissions intensity of a portfolio.

3. Gold greens a portfolio

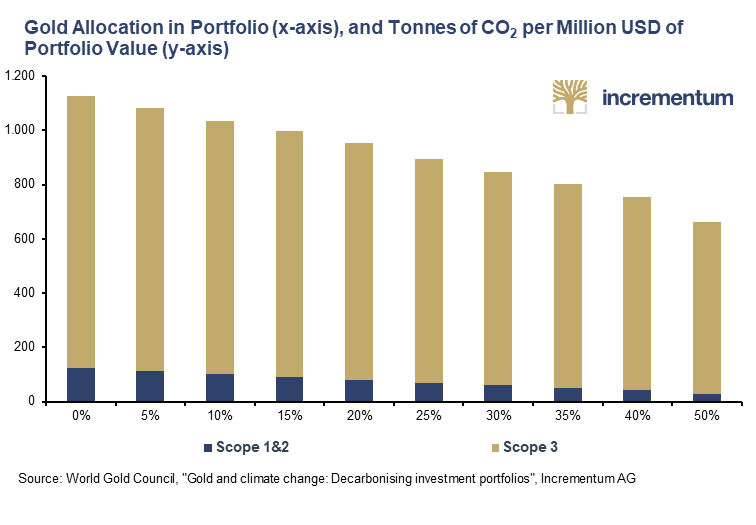

Consequently, an increase in the share of gold in an investor’s portfolio significantly reduces the CO2 footprint and the emissions intensity of the overall portfolio. For a portfolio consisting of 70% equities and 30% bonds, a 10% gold allocation reduces emissions intensity by 7%. A 20% gold allocation reduces emissions by 17%, according to calculations by the World Gold Council in its readable study “Gold and climate change – Decarbonizing investment portfolios.”

4. Fiat money harms the climate and the environment

Fiat currencies, on the other hand, have a major impact on the environment. There are approximately 1.5 trillion coins in circulation worldwide, with a total weight of an estimated 5.25 million tons, consisting mainly of nickel, copper and steel. Banknotes in circulation in 2018 were around 576 billion. Every year, around 150 billion new banknotes are put into circulation. This corresponds to a stock-to-flow ratio of not even 4. Or put another way, a banknote has a life expectancy of just 4 years.

The environmental damage that such enormous quantities of cotton, water, ink, and polymers as well as of metal continually cause is enormous, especially when compared to the 205,000 tons of gold that have been mined to date.

This raises the more than legitimate question of whether our current fiat money system can be classified as sustainable – and this in two ways: on the one hand, sustainable in the sense of ecological compatibility, and on the other hand, sustainable in the economic sense. This is because the negligible marginal costs of paper money production encourage an excessive expansion of the money supply, which causes both ecological and economic distortions.

5. Gold is versatile in its use

Gold is also very sustainable due to other properties. Its specific gravity and malleability make gold the perfect currency. It can be used to transport a large amount of value in a confined space, or it can be hammered into paper-thin gold leaf that is less than a micron thick.. It was highly prized thousands of years ago and is still the first choice of central banks today. Unlike a paper currency, gold reserves do not need to be replenished to maintain purchasing power, because gold is largely immune to inflation.

Conclusion

A closer look reveals beyond doubt that, contrary to a multitude of reports and prejudices spread by the media, gold can already be classified as a very sustainable investment in the sense of the ESG guidelines. And the entire industry is making great efforts to eliminate the remaining blemishes. Beyond the importance of gold for investors and the industry, the undeniable benefits of gold should raise the question of whether the current monetary system can be made more sustainable through greater integration of gold should increasingly come into focus; not only for environmental but also for economic sustainability considerations.

So anyone turning away from gold is in fact turning away from the world’s most sustainable metal in terms of its CO2 balance sheet, the amount of waste and the amount of resources used.

[ad_2]

Image and article originally from www.investmentwatchblog.com. Read the original article here.